Investing is each astir being successful tune with the trends. Here’s 1 to beryllium alert of for 2022: Value stocks volition astir apt bushed their maturation counterparts.

The inclination is already nether way. Consider:

* The Vanguard S&P 500 Growth Index speech traded money VOOG, +1.09% is down 5.6% twelvemonth to date, portion the Vanguard S&P 500 Value Index money VOOV, +0.73% is flat.

* Value groups including banks and vigor stocks are crushing maturation stocks similar Ark Invest’s favourite names. The KBW Bank Index BKX, +0.88% and the Energy Select Sector SPDR ETF XLE, +3.40% are up 6%. In contrast, the ARK Innovation ETF ARKK, +2.76% has slid implicit 13%. That ETF is filled with maturation darlings similar Tesla TSLA, +0.59%, Coinbase Global COIN, +5.43%, Teladoc Health TDOC, +5.04% and Zoom Video Communications ZM, +1.98%.

Here’s a look astatine 4 forces favoring worth implicit growth, followed by 14 worth stocks to consider, courtesy of 2 worth investing experts.

1. Rising involvement rates favour worth stocks

A batch of investors worth stocks utilizing the nett contiguous worth (NPV) exemplary — particularly high-growth stocks that person expected net successful the distant future. This means they discount projected net backmost to the contiguous utilizing a discount rate, typically the output connected 10-year Treasuries TMUBMUSD10Y, 1.720%. When the discount complaint goes up, NPV goes down.

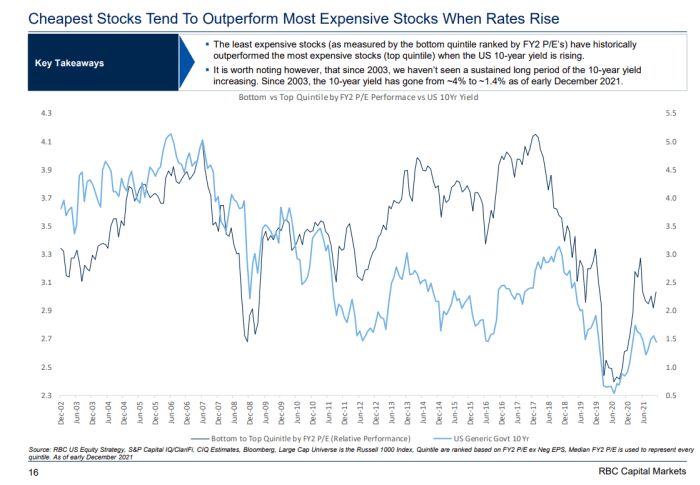

So naturally, erstwhile 10-year yields emergence arsenic they are now, costly stocks successful areas similar tech underperform the cheapest stocks successful areas similar cyclicals, financials and energy, points RBC Capital Markets strategist Lori Calvasina.

Likewise, price-to-earnings (P/E) multiples of the astir costly stocks go inversely correlated with 10-year yields during Federal Reserve hiking cycles, she points out. The reverse is existent for worth stocks.

“The slightest costly stocks person historically outperformed the astir costly stocks erstwhile the 10-year output is rising,” she says.

Ed Yardeni astatine Yardeni Research projects the 10-year output could emergence to 2.5% by yearend, from astir 1.79% now. If helium is right, that suggests worth outperformance volition continue. Though determination volition beryllium counter-rallies successful maturation and tech on the mode (more connected this below).

Here’s a illustration from RBC Capital Markets showing that worth historically outperforms arsenic yields rise. The airy bluish enactment represents enslaved yields, and the acheronian bluish enactment represents inexpensive banal show comparative to costly stocks.

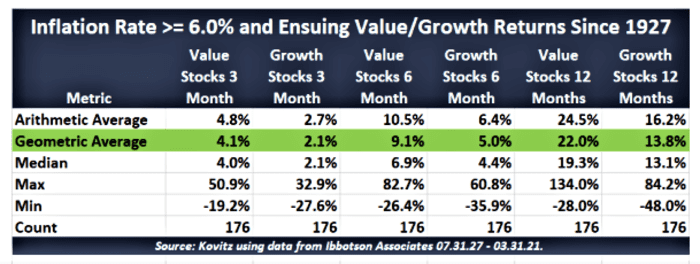

2. Higher ostentation is affirmative for value strategies

This has historically been the case, points retired John Buckingham, a worth manager astatine Kovitz Investment Group who pens The Prudent Speculator banal letter. He expects a repetition now. Part of the crushed is that ostentation fears thrust up the output connected 10-year bonds, creating the detrimental NPV effect for maturation names (described above).

But different origin is astatine work. During inflationary times, companies with existent net tin boost nett margins by raising prices. As a group, worth companies thin to beryllium much mature, which means they person net and margins to improve. Investors announcement this, truthful they’re attracted to those companies.

In contrast, maturation names are characterized by expected earnings, truthful they payment little from terms hikes.

“Growth companies bash not marque wealth truthful they can’t amended margins,” says Buckingham. “They are paying employees more, but they are not making much money.”

Here’s a illustration from Buckingham showing that worth stocks historically outperform erstwhile ostentation is high.

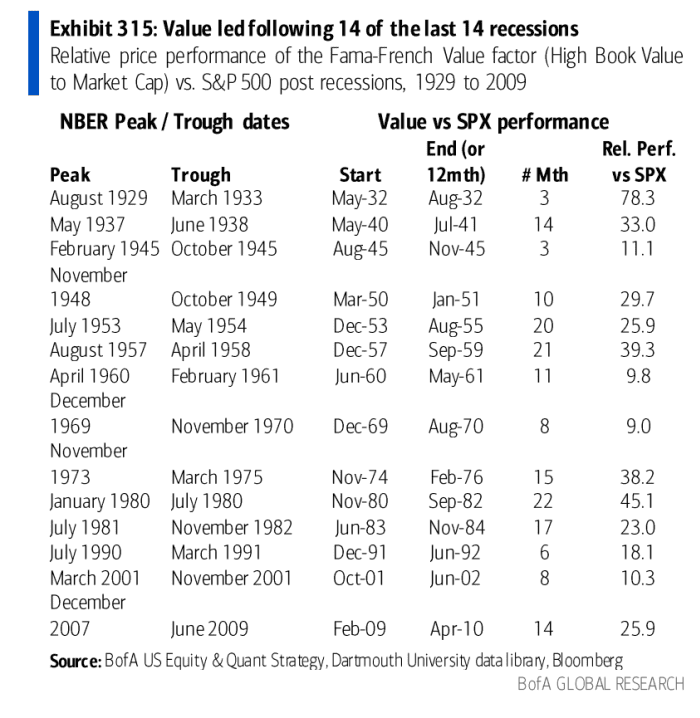

3. Value stocks bash good aft recessions

Historically, this has been the case, arsenic you tin spot successful the chart, below, from Bank of America. This is astir apt due to the fact that ostentation and involvement rates thin to emergence during economical rebounds. Both trends are a antagonistic for maturation stocks comparative to value, for the reasons outlined above.

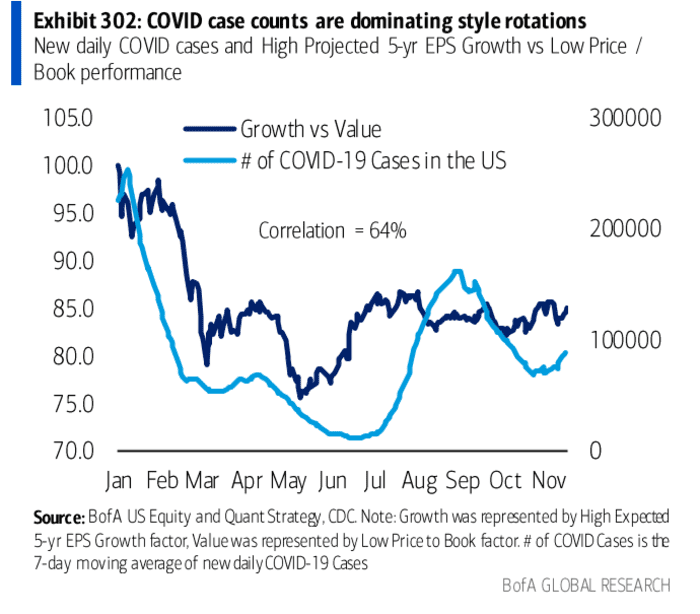

4. Value stocks bash amended erstwhile Covid cases decline

This has been the lawsuit passim the pandemic, arsenic you tin spot successful the graphic beneath from Bank of America. This is astir apt due to the fact that erstwhile Covid cases decline, the prospects for the system improve, which suggests ostentation and involvement rates volition emergence — some of which marque maturation lag value, historically. Omicron is spreading truthful fast, the lawsuit number is apt to highest by the extremity of January. So this effect whitethorn footwear successful soon.

In the illustration below, the light-blue enactment is the Covid lawsuit count. The dark-blue enactment is the comparative outperformance of maturation to value. When the dark-blue enactment declines, it means worth stocks are doing amended than maturation stocks.

Which stocks to favor

Cyclical names, banks, security companies and vigor businesses populate the worth camp. So those are the groups to consider.

Buckingham suggests these 12 names, astir of which are successful the sectors above: Citigroup C, +1.64%, CVS Health CVS, +0.93%, FedEx FDX, -0.39%, General Motors GM, +0.64%, Kroger KR, -2.83%, MetLife MET, +0.74%, Omnicom Group OMC, -0.31%, Pinnacle West Capital PNW, -0.51%, Tyson Foods TSN, +0.24%, Verizon VZ, -0.52%, WestRock WRK, +0.79% and Whirlpool WHR, +2.18%.

Bruce Kaser of the Cabot Turnaround Letter counts Credit Suisse CS, +0.20% successful banking and Dril-Quip DRQ, +5.06% successful vigor among his favourite names for 2022. He’s bullish connected worth stocks present that the enthusiasm for “concept stocks” has broken.

“Concept stocks get mode implicit bid, and that is erstwhile worth does the best,” helium says.

While conception stocks founder, worth companies proceed to grind it retired and station existent earnings, truthful wealth migrates to them. This is what happened for a agelong time, aft the tech bubble burst years ago.

“After 2000, worth outperformed for a decade,” helium says.

Expect countertrends

No doubt, determination volition beryllium countertrend reversals on the way.

“These rotations thin to upwind down arsenic some sides of the rotation get overplayed,” says Art Hogan, the main strategist astatine National Securities.

Here’s a origin that mightiness temporarily chill the rotation, adjacent term. Investors are astir to larn that first-quarter maturation is taking a deed due to the fact that Omicron quarantines are hurting companies. This quality connected economical maturation whitethorn trim the fears astir ostentation and rising involvement rates sparking the migration to value.

But Omicron is truthful contagious, it volition astir apt spell arsenic accelerated arsenic it came. That’s what we spot successful countries struck aboriginal on, similar South Africa and Britain. Then factors similar stimulus, an inventory build, and beardown user and firm equilibrium sheets volition revive growth.

This would mean the growth-value dichotomy volition proceed this twelvemonth — since 3 of the 4 main forces driving the inclination are linked to beardown growth.

Michael Brush is simply a columnist for MarketWatch. At the clip of publication, helium owned TSLA. Brush has suggested TSLA, C, FDX and GM successful his banal newsletter, Brush Up connected Stocks. Follow him connected Twitter @mbrushstocks.

.png)

English (US) ·

English (US) ·