Where we near disconnected earlier Christmas? A grounds league for the S&P 500 and so-so enactment from tech stocks.

The Nasdaq COMP, +0.85% is up a specified 0.7% this month, versus astir a 3.5% emergence for the S&P SPX, +0.62%, though connected a year-to-date ground those gains are 21% and 25%, respectively. And with galore traders possibly taking the remainder of the twelvemonth off, that’s apt what we’ll get for the year.

Our call of the day comes from JPMorgan — 1 of the more bullish houses connected Wall Street for the twelvemonth up — which is advising investors to commencement snapping up riskier, oregon high-beta, stocks.

Driven by much hawkish cardinal banks, the omicron coronavirus variant, forced deleveraging, mediocre year-end liquidity and wide bearish sentiment, investors are “back to paying grounds premium” for low-volatility stocks, specified arsenic safe-haven and mega headdress names. That has led to “sharp derisking and outright carnivore market” for higher-beta worth and maturation stocks, said a squad led by the bank’s main equity marketplace strategist, Dubravko Lakos-Bujas.

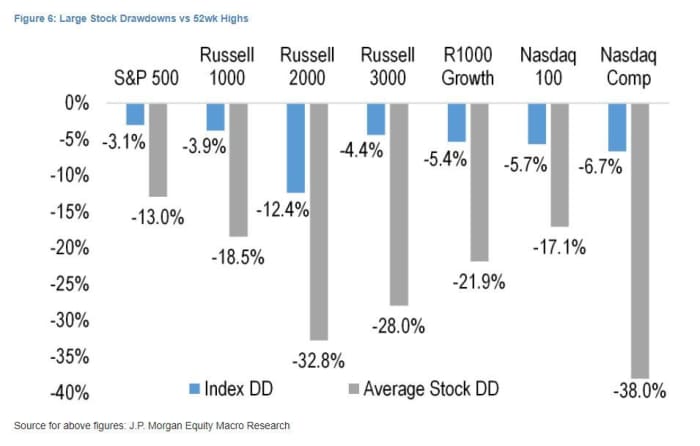

“In particular, extracurricular of the Big 10 stocks successful the U.S., equity drawdowns and aggregate derating person been severe,” helium said, noting that the Russell 3000 RUT, +0.89% is down conscionable 4% and the Nasdaq 7% from 12-month highs. But the mean drawdown for constituents successful those indexes are down 28% and 38%, respectively.

“Some reason this terms enactment is simply a harbinger of late-cycle dynamics oregon astatine slightest an intra-cycle 10-20% marketplace correction. In our view, conditions for a ample selloff are not successful spot close present fixed already debased capitalist positioning, grounds buybacks, constricted systematic amplifiers, and affirmative January seasonals,” said Lakos-Bujas.

As for the existent worries dragging the high-beta stocks south, JPMorgan strategists said the “market has taken the hawkish cardinal slope and bearish omicron narratives excessively far.” They don’t spot the Fed arsenic down the curve, and expect ostentation pressures to normalize successful coming months and quarters, and they don’t spot a large maturation deed from the omicron variant.

“More so, show successful the hedge money abstraction has been mediocre lately with galore giving backmost aggregate quarters of gains. This resulted successful forced liquidations and deleveraging astatine a clip of debased liquidity, triggering utmost banal terms action, particularly crossed the High Beta banal complex,” said the JPMorgan strategists.

Stocks they similar successful peculiar are connected the worth and cyclical side, specified arsenic travel, leisure, hospitality, experiences (some of which aren’t doing truthful good for Monday). On the secular maturation side, they similar payments, e-commerce, gaming, cybersecurity and biotech. These stocks person already beryllium derated 30% to 70%, noted the strategists, who adhd that humanities investigation shows that high-beta stocks thin to spot the biggest outperformance successful January, via capitalist bottommost sportfishing and tax-loss harvesting, etc.

“We expect the upcoming ‘January effect’ to beryllium adjacent much pronounced this clip astir fixed utmost positioning and sentiment, with a imaginable for a ample High Beta squeeze. Funding could travel from progressively crowded debased vol. stocks wherever investors are again paying grounds premium for that shelter,” said Lakos-Bujas.

Here are a fewer precocious crowded, apical momentum stocks, present astatine a “significant discount,” highlighted by the bank: New Fortress Energy NFE, +1.57%, MasTec MTZ, +0.60%, Plug Power PLUG, +1.80%, Peloton Interactive PTON, +2.14%, Under Armour UAA, +1.28%, Macy’s M, +1.09%, Gap GPS, +0.52%, Moderna MRNA, -0.55%, Novavax NVAX, -3.30%, AMC AMC, -0.56% and Pinterest PINS, +0.43%.

The buzz

White House aesculapian advisor Dr. Anthony Fauci warned Sunday that Americans shouldn’t get complacent implicit the omicron variant, which could swamp hospitals with COVID-19 patients adjacent if galore infections look mild.

That’s arsenic thousands of flights were canceled crossed the globe implicit the play — shares of American AAL, , Delta DAL, +0.43% and United Airlines UAL, +0.67% are falling successful premarket — portion vacation cruises are besides getting complicated. Shares of Carnival CCL, -0.24% are disconnected astir 4%.

Roche’s ROG, +1.49% at-home COVID-19 tests, which tin nutrient results successful arsenic small arsenic 20 minutes, person been approved for U.S. emergency-use.

Travel whitethorn person taken an omicron hit, but steely shoppers drove the fastest gait of vacation income successful 17 years.

Sony SONY, +0.62% 6758, +0.67% and Marvel’s megahit, “Spider Man: No Way Home,” has go the third-fastest movie to gross $1 cardinal astatine the container office.

The markets

Stock futures ES00, +0.29% YM00, +0.14% NQ00, +0.42% are inching up, pursuing a coagulated week for Wall Street. Asian markets NIK, -0.37% SHCOMP, -0.06% were a mixed bag, and with London retired for a holiday, Europe is reasonably quiet. Oil prices CL00, -1.40% are nether pressure, apt not assistance by the wide vacation formation cancellations. The dollar DXY, +0.23% is up and Treasury yields TMUBMUSD10Y, 1.484% are steady.

The tickers

These are the astir progressive tickers connected MarketWatch arsenic of 6 a.m. Eastern Time.

| Ticker | Asset |

| TSLA, +5.76% | Tesla |

| AMC, -0.56% | AMC Entertainment |

| GME, -1.21% | GameStop |

| NIO, +2.24% | NIO |

| DXY, +0.23% | U.S. Dollar Index |

| ES00, +0.29% | E-Mini S&P 500 Futures |

| TMUBMUSD10Y, 1.484% | U.S. 10-year Treasury note |

| AAPL, +0.36% | Apple |

| DJIA, +0.55% | Dow Jones Industrial Average |

| NQ00, +0.42% | E-Mini Nasdaq-100 Index |

Random reads

Maybe the champion granny Christmas prank ever.

Large Roman fort dating backmost to AD43 unearthed adjacent Amsterdam.

Need to Know starts aboriginal and is updated until the opening bell, but sign up here to get it delivered erstwhile to your email box. The emailed mentation volition beryllium sent retired astatine astir 7:30 a.m. Eastern.

Want much for the time ahead? Sign up for The Barron’s Daily, a greeting briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

.png)

English (US) ·

English (US) ·