Stock futures are pointing to a rebound but for tech, aft reports of the archetypal U.S. omicron coronavirus lawsuit clobbered Wall Street successful a chaotic time of trading.

For our call of the day, we’re backmost astatine the JPMorgan house, which suggested markets person been overreacting to the caller variant. “What if ‘nu’ variant omicron ends up arsenic affirmative for risk?” strategists asked, concluding that investors should beryllium buying marketplace dips among immoderate cardinal stocks. Note JPM precocious released a fairly bullish outlook for stocks successful 2022.

“Over the past respective days markets person been successful turmoil implicit the caller COVID variant omicron. However, information connected omicron is sparse, accusation contradictory, and immoderate media has been exaggerating risks and highlighting worst lawsuit scenarios,” main planetary strategist Marko Kolanovic and quant strategist Bram Kaplan wrote successful a enactment to clients.

They pointed fingers astatine a “media blitz” connected Thanksgiving evening, 1 of the lowest marketplace liquidity points successful a year, that sent growth-sensitive assets crashing. They took contented with a selloff sparked by Moderna’s CEO, who dashed hopes that existent vaccines volition enactment against omicron. They argued his comments person been “invalidated by reports from Pfizer, Oxford, the WHO and the Israeli Health Ministry.”

Kolanovic and Kaplan said their clients are little disquieted astir the variant and much astir formation restrictions, which person included barring South African flights, but not European ones, wherever cases person besides been spotted.

They described assessments of omicron’s imaginable transmissibility arsenic confusing astatine best. “In elemental terms, erstwhile older variants are spreading via breakthrough infections, caller variants volition ever look to beryllium importantly much transmissible than older ones.” They backed this up with a tweet by biomathemetician Gabriela Gomes.

Early reports suggest it whitethorn beryllium little deadly, and if confirmed successful coming weeks, that could crook omicron into a affirmative for markets, said the pair. Kolanovic and Kaplan raised the anticipation that a little terrible and much contagious variant whitethorn assemblage retired much terrible variants, perchance speeding up the extremity of the pandemic and turning it into much of a seasonal flu. That’s amid vaccines and a increasing database of treatments to tackle COVID, said the strategists.

“If the marketplace were to expect that script — omicron could beryllium a catalyst for steepening (not flattening) the output curve, rotation from maturation to value, selloff successful COVID and lockdown beneficiaries and rally successful reopening themes,” said the team.

“Also, if that script were to happen, alternatively of skipping 2 letters and naming it omicron, the WHO could person skipped each the mode to omega. As such, we presumption the caller selloff successful these segments arsenic an accidental to bargain the dip successful cyclicals, commodities and reopening themes, and to presumption for higher enslaved yields and steepening,” said the bank’s strategists.

Here’s hoping they’re right.

The buzz

Apple AAPL, -2.22% has reportedly warned suppliers that request whitethorn beryllium softer into 2022. Wedbush analysts lifted shares to $200 from $185, connected optimism headed into 2022. They besides spot the “tech stalwart” arsenic a “safety blanket” successful a near-term COVID marketplace storm. Apple shares are down 3% successful premarket trading, and weighing connected tech futures.

GlaxoSmithKline GSK, +0.23% GSK, +0.87% says its COVID-19 Sotrovimab antibody attraction is effective against the omicron variant, but based connected laboratory trial tubes. The U.S. has unveiled its plan for stricter COVID-19 investigating connected planetary travelers.

Meanwhile, infections successful South Africa, which raised the alarm implicit the variant past week, were astatine 8,561 connected Wednesday, doubling successful 24 hours. A apical idiosyncratic successful South Africa has warned that “more terrible complications whitethorn not contiguous themselves for a fewer weeks.”

WeWork shares WE, -4.37% are down aft the co-working abstraction radical said it volition restate financials and admitted a worldly weakness.

A “clerical error” is to blasted for a mysterious batch of GameStop GME, +3.01% shorts listed astatine Fidelity that infuriated the Reddit assemblage this week.

Weekly jobless claims roseate 28,000 to 222,000, and we’re stil waiting connected Federal Reserve speakers, including Atlanta Fed President Raphael Bostic and Fed. Gov. Randal Quarles, are connected pat for Thursday.

The markets

Stock futures ES00, +0.67% YM00, +0.97% NQ00, +0.35% are mixed after that Wednesday’s selloff. Europe equities SXXP, -1.41% are inactive playing drawback up and underwater. Asia was a mixed bag. Oil prices CL00, -1.49% CLF22, -1.49% are rising connected hopes OPEC+ volition decide to intermission monthly output increases astatine Thursday’s meeting. Gold GC00, -0.77% is down and Treasury yields TMUBMUSD10Y, 1.438% are creeping higher.

The chart

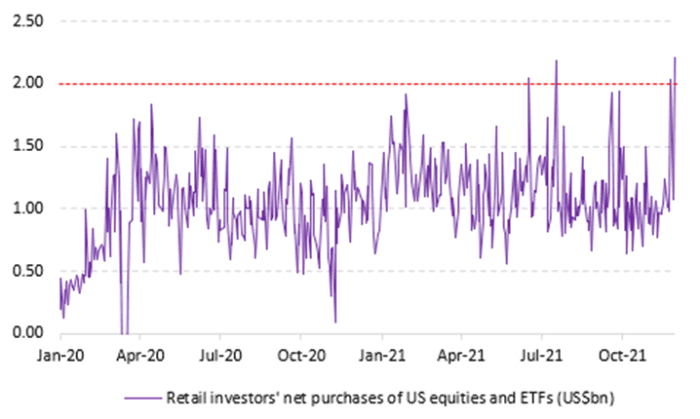

Retail purchases of U.S. equities deed a caller all-time precocious of $2.2 cardinal connected Tuesday, arsenic shown successful this illustration by Vanda Research. Total retail volumes, though were “materially little than successful the aboriginal stages of the pandemic,” writes elder strategist Ben Onatibia and expert Giacomo Pierantoni.

Random reads

Reddit explains immoderate cute Gen. Z sayings specified arsenic “OK, Boomer” — to a millennial (and Gen. Xer’s, this newsman tin confirm).

It’s the twelvemonth of the raunchy Christmas movie.

Why Walmart WMT, +0.67% pulled a rapping, dancing cactus disconnected its online stores.

Just successful clip for the holidays, Tesla TSLA, -0.64% rolls retired a $1,900 Cyberquad for kids.

Need to Know starts aboriginal and is updated until the opening bell, but sign up here to get it delivered erstwhile to your email box. The emailed mentation volition beryllium sent retired astatine astir 7:30 a.m. Eastern.

Want much for the time ahead? Sign up for The Barron’s Daily, a greeting briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

.png)

English (US) ·

English (US) ·